Integrate Bitcoin Seamlessly into Your Treasury Strategy

HOW TO ADOPT A BITCOIN TREASURY STRATEGY

Frictionless enables Bitcoin exposure with institutional precision, allowing treasury teams to scale up or down based on risk appetite, macro conditions, or board mandates.

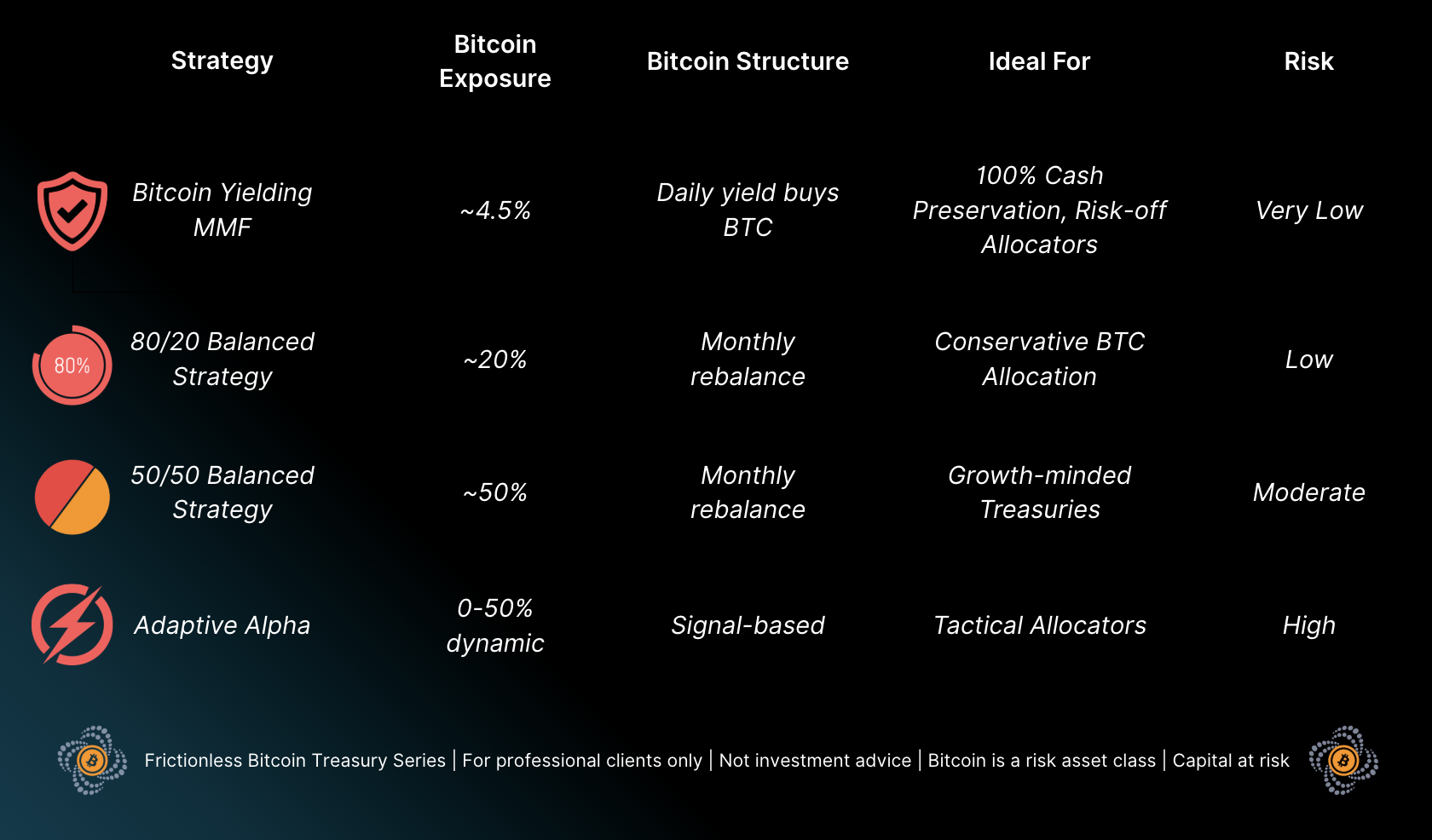

Our integrated strategy suite—Conservative(Risk OFF), Balanced, and Dynamic—offers a seamless way to deploy or reduce Bitcoin allocations without restructuring capital or introducing accounting complexity.

At the foundation, daily money market yields are captured and can be applied to accumulate Bitcoin incrementally. This creates a natural yield-based DCA mechanism, especially useful in conservative or moderately risk-on positions. For those seeking more growth while maintaining control, the Adaptive Alpha strategy introduces a signal-driven approach to dynamically allocate Bitcoin exposure up to 50%. What sets Adaptive Alpha apart is its ability to reduce drawdowns during volatile markets using built-in bear-market filters, offering participation in upside while protecting against downside extremes.

A global treasury solution with integrated flexible risk-on/risk-off Bitcoin exposure

Frictionless Markets delivers a complete institutional Bitcoin Treasury Solution, combining the predictability of money markets with the growth potential of Bitcoin, all within a secure, compliant structure ready for corporate balance

sheets.

Cash-First Foundation

Every strategy starts with a base of institutional-grade liquidity — U.S.

Treasuries, Euro Bonds, and Sterling Gilts.

Tax-Optimized Structure

Bitcoin held as a long-term capital asset within a registered security structure.

Flexible, Dynamic Allocation

Choose your exposure level (0%–50%) across tiered strategies, with no lockups and instant reallocation.

Balance Sheet Integration

Registered, transferable security classified as financial collateral, eligible for direct collateralized financing.

Full Transparency & Auditability

Instant mark-to-market NAVs and real-time proof-of-reserve ensure total reporting confidence.

Direct Ownership

No ETFs. No proxies. No derivatives. You own the underlying Bitcoin, secured in regulated custody.

Built for Institutions

-

Custody & Execution: Utilizing regulated custodians for secure Bitcoin custody.

-

Security Audits: Independent audits conducted by Hacken.

-

Legal Framework: Structured under Luxembourg securitization law.

-

Transparency: Chainlink Proof-of-Reserve for real-time asset verification.

-

Accounting Standards: Aligned with FASB fair value accounting rules effective January 2025.

Performance & Reporting

-

Daily Yield Distributions: Track and verify on-chain.

-

Bitcoin Accumulation: Optimized dollar-cost averaging strategy.

-

Outperformance: Since inception, the fund has consistently outperformed the U.S. Treasury risk-free rate by compounding base yields with strategic Bitcoin accumulation during market dips, offering a materially enhanced risk-adjusted return profile.

Ready to Invest?

Capital at risk. All financial investments involve an element of risk. Therefore, the value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed. You may not get back the amount originally invested.

A Money Market Fund (MMF) is not a guaranteed investment vehicle. An investment in MMFs is different from an investment in deposits; the principal invested in an MMF is capable of fluctuation and the risk of loss of the principal is to be borne by the investor.

The MMF does not rely on external support for guaranteeing the liquidity of the MMF or stabilising the NAV per share.

Short Term Money Market Funds do not generally experience extreme price variations. Changes in interest rates will impact the Fund.

The underlying asset, Bitcoin (BTC) is characterized by significant price volatility, driven by factors such as market demand, investor sentiment, macroeconomic events, and regulatory developments. Its price can experience substantial swings within short timeframes, posing both risks and opportunities for investors. As a digital asset is not backed by any government or centralized entity, its price is driven largely by market speculation, making it subject to significant price swings

Counterparty Risk: The insolvency of any institutions providing services such as the safekeeping of the Underlying Asset may expose investors to financial loss.

CyberSecurity Risk: The hacking or security breach of any institution providing services such as the safekeeping of the underlying asset may expose investors to significant financial loss. In the event of a cyberattack or unauthorized access, these institutions could lose custody of digital assets or sensitive information, potentially resulting in the permanent loss of assets. Additionally, such incidents could lead to disruptions in service, reputational damage, and legal or regulatory consequences, further amplifying the financial risks for investors

Credit Risk: The issuer of a financial asset held within the Fund may not pay income or repay capital to the Fund when due.