Transform your capital raising reach

Raise more capital from more investors in more markets with more currencies. The Frictionless platform makes it faster, safer and more efficient to launch any tokenized asset class, fund or investment strategy on any blockchain with ultra-low minimums and incredible efficiency.

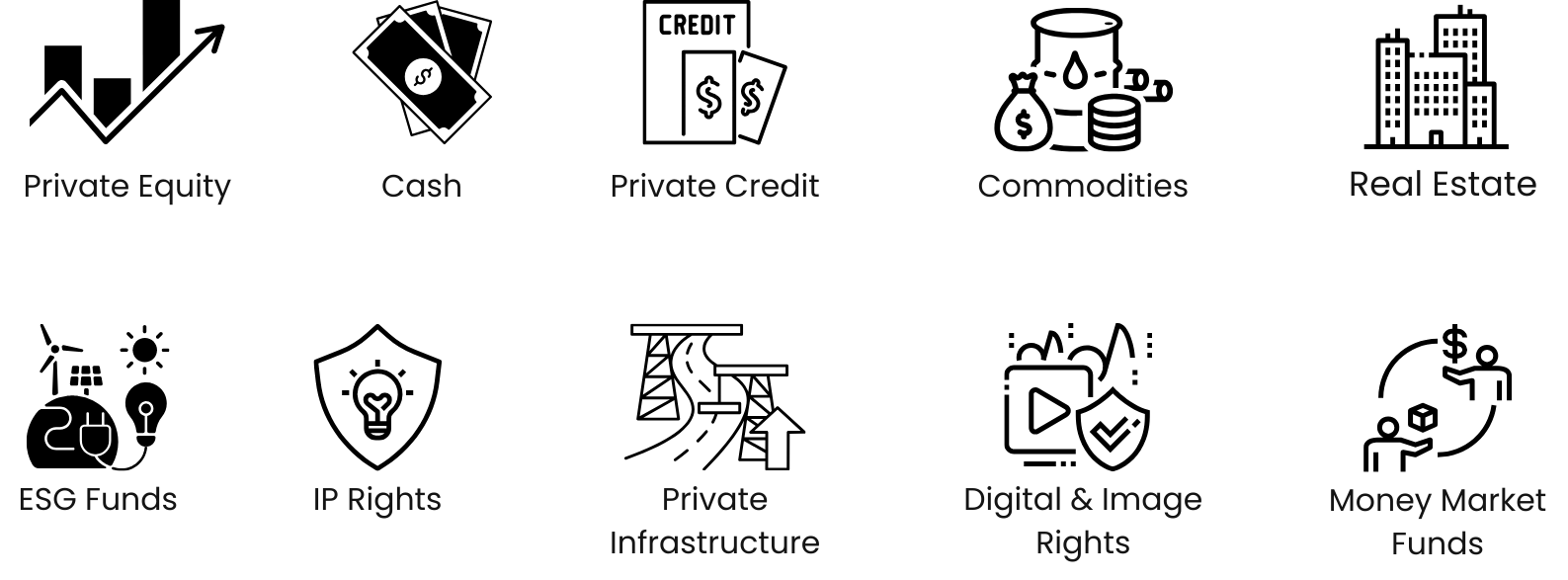

Boundless Possibilities

Any asset, fund, or strategy can be tokenized. Frictionless tokenization supports all asset classes, allowing for the legal issuance of digital securities under MiFID II regulation. Our platform and fund structuring solutions are tailored for frictionless, 24/7/365 investment, trading, and settlement of funds globally, across any venue, and in multiple currencies.

Our Offering

Launching a fund is time, cost & energy-consuming, and adding technological risk into the mix sets barriers to tokenization adoption, at Frictionless our platform, fund structuring and audited tokenization technology eliminate those barriers. The Frictionless platform makes it faster, safer and more efficient to launch any tokenized asset class, fund or investment strategy on any blockchain with ultra-low minimums and incredible efficiency.

FUND FORMATION

-

- Structuring & Fund Formation Packages

- Self & Full Service Administration

- Reporting (ILPA standard)

- Audited

- Regulated Security Trustee (Optional)

- Multi-Currency

- Orphan-Entity, Cash-Segregated, RingFenced

TOKENIZATION

- Issuance of digital securities (MiFID II)

- Tokenized Cash (Instant Settlement)

- Tokenized Fund Units (Real-time reporting)

- Seamless Subscriptions

- Automated Capital Calls

- Automated Cash Distributions

- Digital Investor Onboarding

- Regulated FX, Invest & Settle in multiple currencies

DISTRIBUTION

-

- Network of regulated distribution agents

- Token integrations

- Automated primary & secondary markets

- Multi-mode distribution

- Client-Directed

- Advised

- Nominee

Instant Benefits, Instant Payoff

Our offering not only brings your product to market faster but also at a lower cost with enhanced features. It reduces your fund's total expense ratio and eliminates costs and friction by removing counterparties.

Lower TER

Instant & automated capital calls and distributions

Lower costs in fund formation and structuring

More automation and fewer counterparties (such as Transfer Agent, Paying Agent, Settlement Agent, and Registrar) without compromising compliance and safety.

Lower TERs and increased efficiency significantly impact fund distribution, allowing managers to concentrate on higher-margin, smaller-ticket investments on the primary side.

Broad Access

Lower TERs and ultra-low minimums enable broader access base of Investors

Simple, intuitive digital solutions enable 365/24/7 markets

The institutions are coming here!

Still unsure if tokenization is just a trend or something your fund should actively be pursuing? Here’s the Chairman & CEO of BlackRock explaining why one of the world’s largest asset managers, like Frictionless, is trailblazing the way in tokenization.

“We believe that tokenization is a transformation of financial assets. Every transaction will be instantaneous and every individual will have their own wallets and the services will be customised. Tokenization is all about removing friction, friction in settlement, offering, issuing, and composing portfolios.”