fsGBP - Frictionless British Pounds Sterling

Institutional, digital British Pounds Sterling that works seamlessly and instantly across international markets, by leveraging next-generation tokenization infrastructure that’s more secure, far more efficient, lower cost, and more transparent than legacy rails, such as the correspondent banking network or SWIFT.

Institutional-grade, digital British Pounds Sterling which moves between permissioned counterparties instantly across international markets 365/24/7, with zero fees* and no settlement risk**

* Frictionless Markets does not charge management or redemption fees on fsGBP. Transfer fees on transactions processed by the Frictionless protocol on behalf of institutional clients are completely fee-free. Institutional clients also have the option to execute their own transfers for just a few cents, irrespective of the transaction amount.

** The Frictionless audited smart contracts guarantee that the atomic settlement of fsGBP on-chain happens instantly. However, the settlement of the corresponding fiat currency is managed by the cash custodian. Typically, this occurs within the same business day, but it may take overnight or longer to clear with your registered bank account, depending on the custodian's processing times.

| Eligibility | Professional Clients, Qualified Clients and Qualified Investors Only | |

| Underlying | Currency (British Pounds Sterling) | |

| Uses | Instant Capital Calls, Instant Settlement, Instant Legal Cash Collateral | |

| Fees | Zero Fees* | |

| Transferability | Instantly transferrable between permissioned holders | |

| Custodian | Citibank International Limited | |

| Redemptions | Daily 16:00 CET (Luxembourg) | |

| Legal Structure | Zero-Coupon Note (non-yielding, zero-fee, tokenized debt security) issued by bankruptcy remote, orphan-entity protected compartment of Frictionless Markets Securities FT. | |

| Regulatory Compliance | Issued by Frictionless Markets Securities FT under the MiFID II prospectus regulation, Securitization Law of 2004 (Luxembourg as amended), Financial Collateral Act 2005 (Luxembourg as amended), Blockchain Acts of Luxembourg (I, II, III as amended) | |

| Documents | ||

| Networks |

Institutional-grade, digital British Pounds Sterling, that moves frictionlessly onchain.

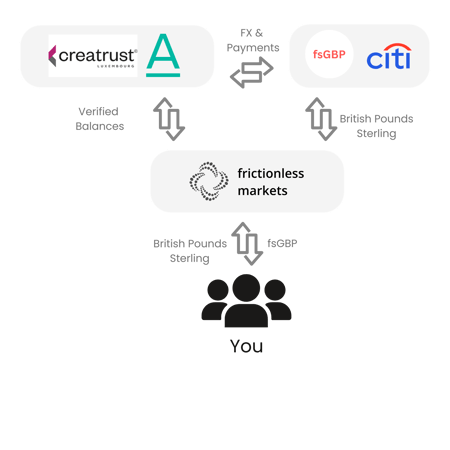

fsGBP is engineered to provide institutional clients with the best of both worlds, the speed and efficiency of tokenization, combined with the security and control required for managing institutional capital flows.

Operate in global markets without settlement risk, transactions settle instantly

Eliminate intermediaries, instant spot & forward FX is available in all Frictionless Institutional Deposit Tokens

Leverage as legal financial collateral under the Luxembourg Financial Collateral Act 2005

Frictionlessly move between stablecoins for maximum liquidity onchain

Independently Attested, Tax Transparent, Bankruptcy Remote

All currency backing fsGBP is held at Citibank International (Luxembourg). Frictionless does not actively invest your funds, ensuring they are always accessible and redeemable instantly. This is confirmed daily by our independent Fund Accountants, guaranteeing a 1:1 redemption rate for fsGBP.

Frictionless Markets Securities operates within a Luxembourg-based, bankruptcy-remote structure with orphan entity protection, ensuring client assets are segregated and secure.

Our EU-based, tax-transparent vehicle provides clients with confidence and compliance under FATCA and CRS regulatory standards.

Compliance & Control Assured

fsGBP is a permissioned, tokenized certificate representing a KYC/AML-verified holder's securitization of British Pounds Sterling in a segregated, secure cash custody account. Our institutional-grade infrastructure ensures that the minting and burning of fsGBP are directly tied to the British Pounds Sterling held in these segregated cash custody accounts.

Frequently Asked Questions

See the full FAQ

Is fsGBP a stablecoin?

No, fsGBP is a permissioned, tokenized certificate representing the securitization of British Pounds Sterling for KYC/AML-verified holders, stored in a segregated, secure cash custody account.

Unlike stablecoins, which are typically permissionless and involve the issuer investing your funds into cash equivalents and money market funds to earn interest, Frictionless does not invest your funds. This approach ensures that your funds remain accessible and can be redeemed instantly. Our registered independent Fund Accountants attest to this mandate daily, guaranteeing the instant redeemability of your Frictionless Institutional Deposit Tokens.

How do I get fsGBP?

After you are onboarded and verified, your account and wallet addresses are permissioned into the Frictionless protocol. You can then deposit British Pounds Sterling into your account. Once the funds clear, your fsGBP tokens are minted and transferred to your account. This process usually happens within the same business day, but depending on your bank's processing times, it may take overnight or longer to complete.

How do I redeem fsGBP?

Holders can redeem their institutional deposit tokens for fiat directly to their registered bank account by either:

- Submitting a redemption request through their Frictionless portal account.

- Transferring their tokens to the settlement address.

Redemption requests submitted before 16:00 CET will be processed on the same day. Requests received after 16:00 CET or on a non-business day will be processed on the next business day.

Who can mint, redeem or hold fsGBP?

Only KYC/AML-verified clients who are permissioned on the Frictionless protocol can send or receive Frictionless Institutional Deposit Tokens.

Verified holders can freely transfer tokens between each other directly. For added market protection, any attempt to transfer tokens to a non-permissioned wallet address (such as that of an ineligible investor) will result in the transaction being blocked, and a SARs report will be automatically generated.

Is fsGBP compliant with regulatory requirements?

We have collaborated closely with specialist legal counsel, our structuring team and the Luxembourg regulator (CSSF) to implement a structure which complies with securities laws, tax laws, anti-money laundering laws, and other regulatory requirements.

Frictionless Institutional Deposit Tokens are registered notes that adhere to the MiFID II prospectus regulation, the 2004 Securitization Law of Luxembourg, the 2005 Financial Collateral Act of Luxembourg, and the Blockchain Acts I, II, and III of Luxembourg.

Each token issued by Frictionless Markets originates from its own segregated compartment within the bankruptcy-remote structure of Frictionless Markets and is classified as a financial instrument. Frictionless Institutional Deposit Tokens are crypto assets recorded in the DLT that qualify as financial instruments under the laws of 2004, 2005, and 1915, and therefore currently fall outside the scope of the MiCA regulation.

How do I convert fsGBP to another currency?

fsGBP can be exchanged for any other supported Frictionless Institutional Deposit Token either on a spot or forward basis.

Spot conversions will occur at the current exchange rate provided by our regulated FX partner, Alpha FX, through Frictionless Markets.

Forward conversions are available upon request via our portal.

Please note that our FX desks operate during core business hours.

Can I swap fsGBP for USDC or EURC?

Yes, But first you must perform an FXSwap of your fsGBP to the matching currency of fsUSD for USDC or fsEUR for EURC.

Thereafter, Frictionless offers instant ERC20 swaps through our partnership with Circle and other VASP-registered custodians in the EU.

For more information on ERC20 swaps, click here